Acquiring a Car From a Supplier

Only after you've negotiated this price must you discuss your trade-in. If the dealership will not resemble matching the cost you can get in a personal sale or from a used-car dealership, take the trade-in off the table and sell your old auto somewhere else. But if you've concurred with the dealership on a trade-in rate for your old auto with the intention of using it to your deposit, only then need to you discuss funding. After that most likely to the new car dealer and also negotiate the cost of the brand-new automobile.

Can you buy a car without a dealership?

Your payment: Payment can be a check from a bank or credit union for a preapproved loan. When the dealership is handling the financing, the down payment, it can be in the form of a cashier's check, a personal check or even a credit card payment.

Now recognizing the amount you require to fund, have your finance pre-approved by a financial institution, as opposed to the dealer. Only if the dealership comes back with financing terms that beat those of your financial institution-- which frequently takes place in the 11th hr-- ought to you go with their lending.

Constantly Test Drive the Automobile.

Short-lived drive-out tags (great for seven days) are available from dealers and also at auctions. Auto dealers have the ability to help with the acquisition of short-lived plan, so ask your car supplier concerning it. Generally, temporary car insurance can last as much as 28 days, however you can additionally obtain covered for as low as eventually. With a new vehicle acquisition, provide yourself sufficient insurance coverage to offer you the opportunity to purchase a full policy.

- They could or could not be considering the rate of interest costs.

- The better your performance history with securing lendings as well as making payments on schedule, the far better your score will certainly be.

- You might also intend to consider checking into the distinctions between vehicle loan and also individual loans.

- Nevertheless, paying money will certainly not always assure you a far better rate, and also as a matter of fact, it could cause you to pay a greater cost.

- When negotiating, having an excellent sensation in advance of time for what to say-- and what not to say-- will assist offer you an edge.

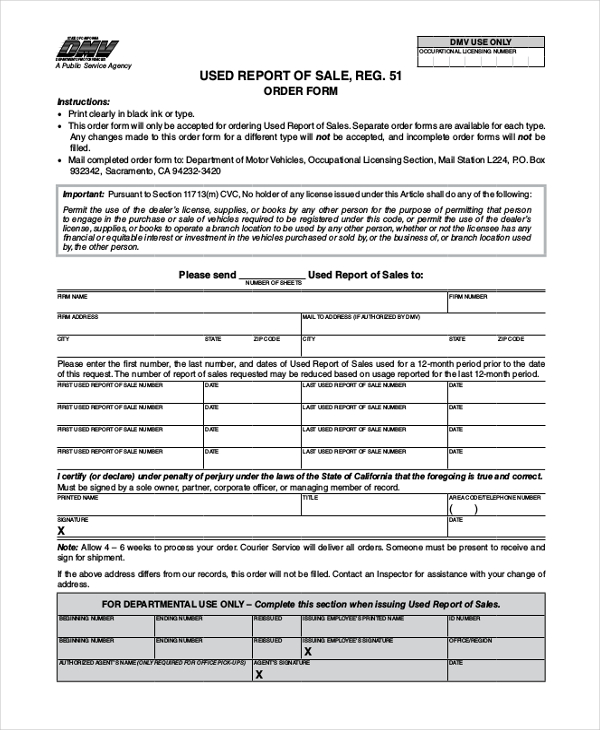

Nevertheless, there still many unpredicted dangers when acquiring a brand-new Learn more here car, and if you don't know how to detect them, you can wind up paying hundreds of bucks more than you should. When you're buying a car, here are the leading 5 tricks suppliers make use of to tear you off. Car dealerships give short-lived plates; for personal sales, the purchaser can buy a temporary plate at any type of DMV workplace. If you have actually acquired a lorry from an authorized dealership or vehicle public auction, just.

Do dealerships like when you pay cash?

Car dealerships are able to help with the purchase of temporary policy, so ask your car dealer about it. Typically, temporary car insurance can last up to 28 days, but you can also get covered for as little as one day.

How Much Should I Invest In a Car?

Does the IRS know if I buy a car?

Paying With Cash Won't Give You Negotiating Leverage Often dealers make a little bit of money of the loan that they give you. These products bring a lot of profit to the dealers, so if they know right away they can't make any money off you from F&I, they may be less likely to cut a good deal on the car itself.

If the published cost, motivation, deal or various other service is wrong as a result of typographical or various other mistake we will just be responsible for honoring the correct cost, motivation or deal. Paying money will certainly decrease your time invested in a dealership, and also you can stay clear of rate of interest costs if the auto you are acquiring does not offer 0% APR financing. Nevertheless, paying cash will not always assure you a far better price, and actually, it might create you to pay a greater cost. Something to keep in mind when buying an auto is that carmakers and also dealerships wish to remove inventory so older automobiles aren't taking on more recent versions.

Do dealerships give temporary insurance?

Here are the top five tricks dealers use to rip you off when you're buying a car. 1. Mixing negotiations. Mixing these negotiations allows them to show the buyer one favorable figure, like the new-car price, while obscuring a less favorable figure, like the trade-in price or financing terms.